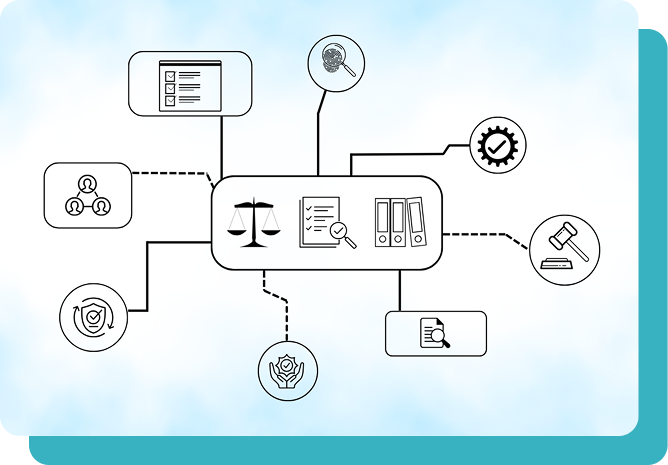

Open Data Intelligence &

Compliance Screening

Our tech-enabled Open Data Intelligence solution delivers relevant insights to identify known risks and support compliance.

Our Values

Our work focus, along with proactively designed systems and processes, is dedicated to ensuring the highest level of confidentiality and data protection. We take great pride in consistently delivering our services with outstanding professionalism, always upholding the highest ethical standards and integrity.

This steadfast commitment to our core values is evident in every aspect of our operations, ensuring that we reliably meet and exceed expectations while building lasting trust with our clients.

Our Services

iKYC

Processes requiring multiple document submissions for initial identity checks.

aKYC

Faster verification using biometrics for remote verification.

cKYC

Centralised Digilocker records to avoid repetitive submissions.

vKYC

Remote online verification via video authentication

eKYC

Ensure risk mitigation through external database checks.

oKYC

Provide open source and subscriber database screening by leveraging advanced technology.

OpenDataIntel™

Open Data Intelligence is meticulously collated in real time from hundreds of diverse public sources, including relevant global regulators, industry databases, and authoritative public records, through Fios Compliance’s proprietary automated process. This advanced technology enables comprehensive and dynamic searches, significantly enhancing the capabilities of risk and compliance teams with Compliance as a Service (‘CaaS”) input.

By delivering timely, accurate, and up-to-date results, it empowers organizations to make better-informed decisions, proactively manage emerging risks, and maintain robust reporting standards in an increasingly complex and global regulatory environment.

About Fios